How Much Does a Startup Need to be Worth for an Early-Stage Job Offer to Make Sense?

I was offered a role as co-founder and CEO of a venture-backed startup a few years ago. The business I was offered a role at focused on solving eye strain issues in the workplace by offering blue-light-blocking glasses to professionals.

The market for this product was large and growing and the VC who was courting me for the position had already gathered strong research validating key business assumptions.

The VC thought I was a good fit for the role based on my expertise and experience in marketing and I was pretty excited about the opportunity and business.

But when it came time to assess the value of the package that was being put in front of me, I didn’t know how to judge it.

Was I getting a good offer or a bad one? In the land of startups, it can be hard to tell.

I didn’t know so I reached out to my friend Trevor Sumner who’s a successful entrepreneur with multiple exits and invests and advises startups.

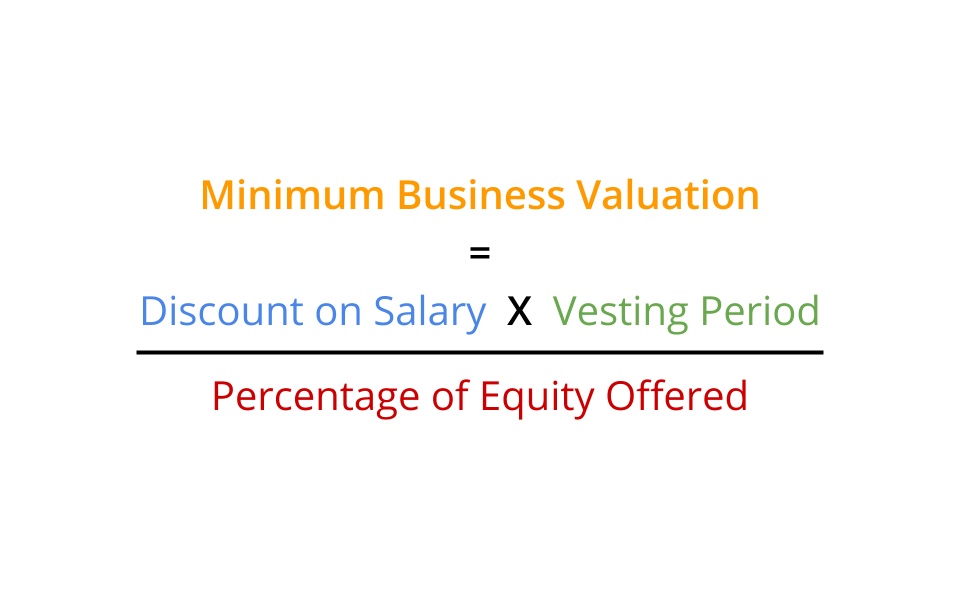

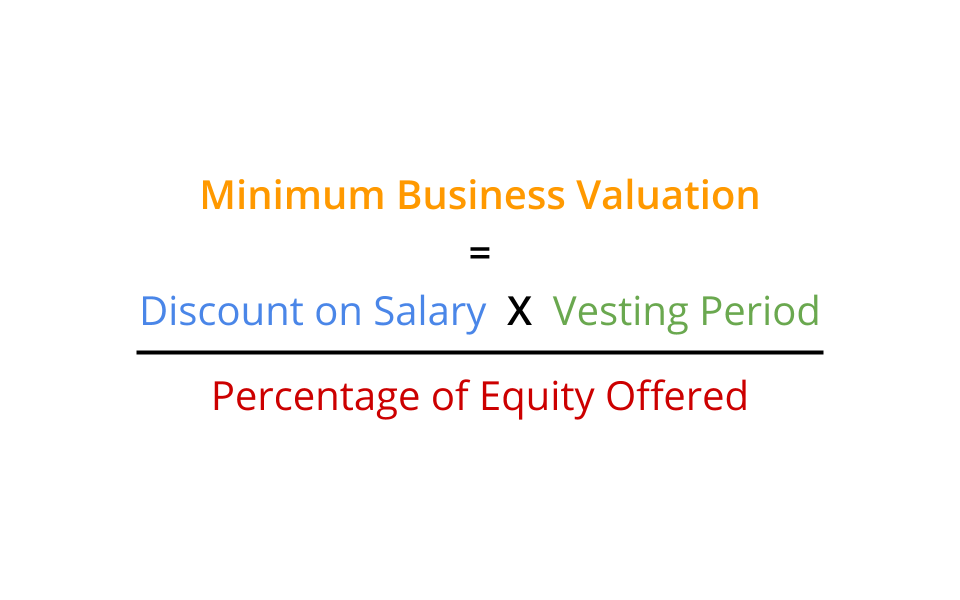

He taught me a simple framework to answer whether the total compensation package you're being offered is fair given the company’s current valuation.

The discount you take on your salary needs to be made up for by the annual value you receive in equity.

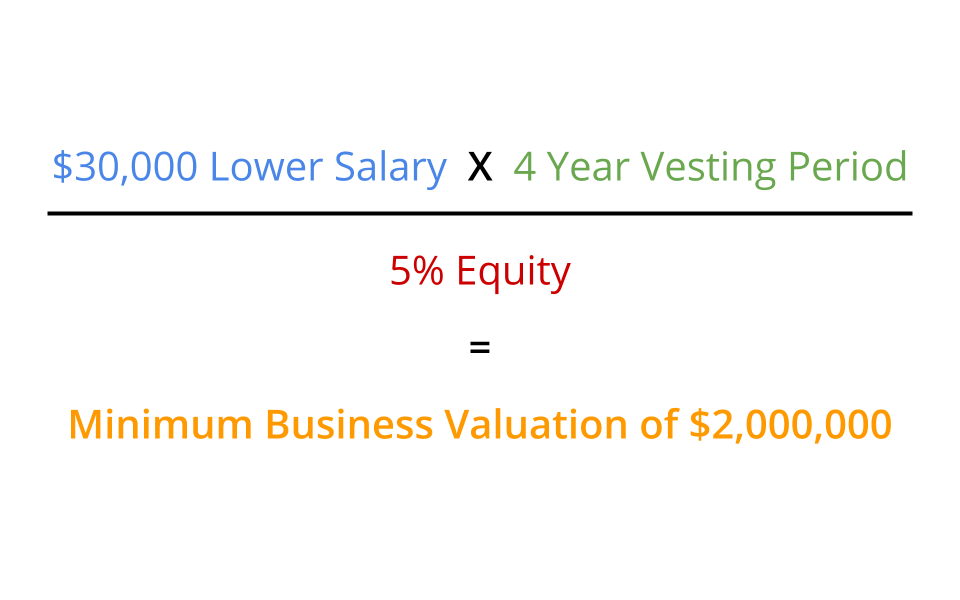

So let’s say you currently expect to get paid $120k in annual salary given your expertise and experience.

Is a job offer at a startup with $90k salary, 5% equity, and a vesting period of 4 years a better offer financially speaking?

For this offer to make sense, the annual value of equity needs to exceed the annual discount you're taking on salary.

Calculating this number gives us a required minimum business valuation.

Using relatively straightforward math you simply multiply the $30k discount we would take in annual salary by our vesting period of 4 years and divide it by the 5% total equity we're being offered. This gives us a minimum business valuation that we can use to anchor the value of the equity that's being offered to us.

Not accounting for other factors, the business would have to be worth at least $2 million for the 5% equity you're being offered to be worth the lost $30k in annual earnings.

With these numbers in hand, we stop negotiating against ourselves by judging equity through the lens of psychological traps such as "what percentage of equity seems like a large number" and instead can ask more serious questions like: "Is this business really worth this minimum business valuation at its current stage?"

Many startup founders offer a bad trade-off between equity and compensation when they make offers to new employees, but it doesn't mean you have to accept their math and reasoning in how you make your choice.